TORONTO, Nov. 12, 2015 /CNW/ – Baylin Technologies Inc. (TSX: BYL) (the “Company” or “Baylin”), a global provider of innovative antenna solutions for the networking, mobile and wireless infrastructure markets, today announced its financial results for the three and nine months ended September 30, 2015. All figures are stated in United States dollars unless otherwise noted.

Key Outcomes for the Quarter

- Revenue in Q3 2015 of $12.1 million, up 21.1% quarter-over-quarter.

- Gross profit in Q3 2015 of $2.7 million, up 23% quarter-over-quarter.

- 70% of the cash used this quarter funded growth.

- Adjusted EBITDA without the Headquarter and IT transition cost was $(0.8M) which demonstrates a 39% reduction over Q2 2015 result. Our cost reduction and restructuring efforts are making the financial improvements we anticipated.

- 70% of our cash used in the quarter related to our increase in accounts receivable due to our increase in sales over the same period.

- Appointed Vice-Chairman Randy Dewey as President and Chief Executive Officer.

Fiscal Q3 2015 Highlights

- Revenue in Q3 2015 was $12.1 million, up 21.1% from $10.0 million in Q2 2015.

- Gross profit for Q3 2015 was $2.7 million, up 23% from $2.2 million in Q2 2015.

- Gross profit margin was 22.5% in Q3 2015, compared to 22.2% in Q2 2015.

- Adjusted EBITDA in Q3 2015 was $(1.3) million. Without consideration to transition costs of the head office, migration of IT systems, and certain management changes, Adjusted EBITDA would have been $(0.8M) for Q3, reflecting an improvement of approximately $0.5 million quarter-over-quarter.

- Total cash and cash equivalents were $12.3 million at September 30, 2015.

- Implemented key organizational changes to support long-term growth.

- Hired veteran industry sales people.

- Strengthened senior leadership team particularly in manufacturing

- Continued optimization of working capital resulting in finished goods inventory of $3.7M at September 30, 2015. This is a decrease of $0.8M from the end of the first quarter of this year, while sales increased from $8M in Q1 to more than $12M in Q3. Approximately 70% of the cash used in the quarter was to fund the increase in accounts receivable that resulted from our sales increase over the same period.

- Signed agreements with two new mobile original equipment manufacturers (“OEMs”).

“We are encouraged by the continued sequential improvements in all of our key financial metrics in the quarter,” said Randy Dewey, President and Chief Executive Officer. “Sales were up across all three product lines. Our revenue growth offset approximately $0.6M in costs related to moving our head office to Toronto, a significant portion of which were charges that will not continue past Q4 of this year. In the quarter, we also took steps to optimize our working capital with better inventory management. The benefits of which were reflected on our balance sheet at quarter end.”

Mr. Dewey added: “We expect that our results in the fourth quarter will be similar to our performance in Q3. However, the vast majority of our turnaround efforts are now behind us, including bolstering our senior leadership team. Our primary focus remains building a stronger sales culture to fuel continued growth across all three of our product lines. We are increasingly diversifying our revenue in Mobile, seeing sales growth with major customers in Networking and building a strong pipeline in Infrastructure. We remain confident in our long-term opportunities and expect to drive continued performance improvements in fiscal 2016.”

The Company’s complete financial statements and Management’s Discussion & Analysis for the three and nine months ended September 30, 2015 are available at www.baylintech.com/investor-relations/ and www.sedar.com/.

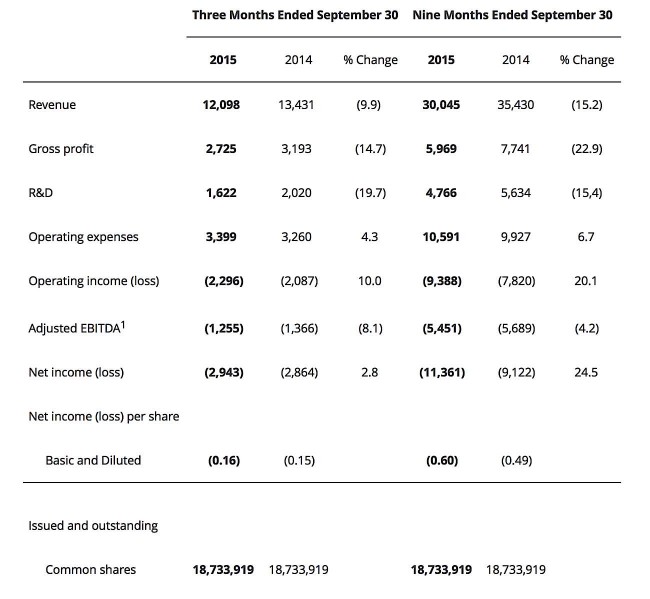

Financial Summary

Revenues

Revenues for Q3 2015 were $12.1 million, an increase of $2.1 million over $10.0 million in Q2 2015. Compared to Q3 2014, revenues declined 9.9%. The year-over-year decrease resulted from a substantial reduction in orders from a key Mobile customer, which was offset, in part, by stronger sales in the Networking and Infrastructure product lines.

Gross Profit

Gross profit for Q3 2015 was $2.7 million, an increase of $0.5 million over $2.2 million in Q2 2015. Gross margin for Q3 2015 was 22.5%, compared with 22.2% in Q2 2015. These sequential improvements reflect a reduction in fixed manufacturing costs and a higher contribution margin on the Company’s variable costs. Q3 2014 gross profit was $3.2 million and gross margin was 23.8%.

Research and Development

Research and development (“R&D”) costs were $1.6 million in Q3 2015, a decrease of 19.7% over Q3 2014. The year-over-year decrease in R&D costs was driven by a reduction in headcount which occurred at the end of Fiscal 2014. Other development costs were relatively stable due to a reduction in patent expenses. R&D costs in Q2 2015 was $1.5 million and was relatively stable when compared to Q3 2015.

Sales and Marketing

Sales and Marketing costs for Q3 2015 were $1.0 million compared to $1.0 million for Q3 2014. The recruitment of new sales people hired during the third quarter of 2015 to support the Company’s growth in new business areas was offset by reductions of expenses due to tradeshows, travel expenses and other related expenses as part of the Company’s cost reduction initiatives. Sales and Marketing was flat quarter-over-quarter.

General and Administrative

General and administrative (“G&A”) costs were $2.4 million for Q3 2015, compared to $2.3 million for Q3 2014. G&A expenses increased because of certain professional services rendered during the quarter and severance costs following the departure of a senior executive. G&A expenses were relatively flat quarter-over-quarter.

Adjusted EBITDA

Adjusted EBITDA was a loss of $(1.3) million in Q3 2015 and was relatively flat compared to Q2 2015. There were several expenses that drove a higher Adjusted EBITDA loss in the quarter. These charges were mostly related to the migration of the head office from Israel to Toronto, consulting on manufacturing optimization and recruit of key talent.

Net Income (Loss)

Net loss in Q3 2015 was $2.9 million, an increase of $0.2 million over a net loss of $2.7 million in Q2 2015. Compared with Q3 2014, net loss remained relatively static despite a 9.9% decline in revenues.

Liquidity

As at September 30, 2015, the Company had cash and cash equivalents totaling $12.3 million and working capital of $11.8 million. The Company saw an increase in trade receivables of $2.9 million compared to December 31, 2014. Approximately 70% of the cash used in the quarter related to our increase in accounts receivable due to our increase in sales over the same period. Our DSO was stable on sequential basis from the beginning of the year.

Conference Call

Baylin will hold a conference call to discuss its 2015 third quarter financial results today, November 13, 2015, at 8:30 a.m. (ET). The call will be hosted by Randy Dewey, Vice-Chairman, President and Chief Executive Officer. All interested parties are invited to participate.

| DATE: | November 13, 2015 |

| TIME: | 8:30 a.m. ET |

| DIAL IN NUMBER: | (647) 427-7450 (888) 231-8191 |

| CONFERENCE ID # | 75034519 |

| TAPED REPLAY: | 416-849-0833 or 1-855-859-2056 Available until 12:00 midnight (ET) November 20, 2015 |

| Reference number: 75034519 | |

| LIVE WEBCAST: |

http://bit.ly/1RvQ7Ds |

(1) Non-IFRS Measures

Baylin uses EBITDA and Adjusted EBITDA to measure its financial performance and its future ability to generate and sustain earnings. EBITDA refers to earnings before interest (finance expenses, net), taxes, depreciation, and amortization and discontinued operations. Adjusted EBITDA refers to EBITDA less items of an exceptional nature outside of the ordinary course of business. Such items include, but are not limited to, certain exceptional, non-recurring share-based compensation, capital gains and losses, restructuring costs, recognition of significant provisions and other significant non-cash transactions. We do not believe these items reflect the underlying performance of our business. EBITDA and Adjusted EBITDA are non-IFRS performance measures. Besides net earnings, EBITDA and Adjusted EBITDA are useful complementary measures of pre-tax profitability and are commonly used by the financial and investment community for valuation purposes.

Forward Looking Statements

Certain statements in this news release, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Often, but not always, forward-looking statements or information can be identified by words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Regarding forward-looking statements and information contained, we have made numerous assumptions. Although our management believes that the assumptions made and the expectations represented by such statement or information are reasonable, there can be no assurance that any forward-looking statement or information referenced will prove accurate. Forward-looking statements and information are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks, uncertainties and other factors include those risks identified in Baylin’s annual information form dated March 20, 2015 filed on SEDAR at www.sedar.com.

Although we have attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking statements or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Also, many of the factors are beyond the control of Baylin. Readers should not place undue reliance on forward-looking statements or information. Baylin undertakes no obligation to reissue or update any forward-looking statements or information because of new information or events after the date except as required by law. All forward-looking statements and information are qualified by this cautionary statement.

About Baylin

Baylin (TSX: BYL) is a leading global technology company with over 37 years of experience in designing, producing and supplying innovative antennas for the mobile, Networking and wireless infrastructure industries. We strive to meet our customers’ needs by being their trusted partner from initial design to production with an extensive portfolio of custom engineered solutions and leading edge off-the-shelf antenna products.

SOURCE Baylin Technologies Inc.