Investor Conference Call on May 11, 2021 at 8:00 a.m. ET

TORONTO, CANADA – May 10, 2021 – Baylin Technologies Inc. (TSX: BYL) (the “Company” or “Baylin”), a leading diversified global wireless technology company focused on research, design, development, manufacturing and sales of passive and active radio frequency products, terrestrial microwave products, and services, today announced its financial results for the three months ended March 31, 2021. All amounts are stated in Canadian dollars unless otherwise indicated.

KEY HIGHLIGHTS

Key highlights for the three months ended March 31, 2021 include the following:

- Revenue was $23.5 million in the first quarter of 2021, a decrease of $3.4 million or 12.9% compared to the first quarter of 2020.

- Ongoing and implemented cost reduction initiatives continued to yield benefits with operating expenses $2.6 million lower than the first quarter of 2020.

- Net cash as at March 31, 2021 increased by $1.4 million from December 31, 2020 mainly due to proceeds from the exercise of common share purchase warrants issued in December 2020 and drawdown of the Vietnam Loan, offset by principal and interest payments, cash taxes and loss incurred on a consumer product in the Asia Pacific business line.

- Open customer orders as at March 31, 2021 showed strong improvement compared to December 31, 2020 and March 31, 2020 values.

RECENT DEVELOPMENTS

COVID-19

The coronavirus (COVID-19) pandemic had a continued significant impact on revenue, sales mix and margins in the first quarter of 2021 particularly for the Infrastructure and Satcom business lines. The Infrastructure business line saw a slower than anticipated recovery of its products but nevertheless received approval from a Tier 1 carrier to manufacture two types of base station antennas which will benefit the business line in future periods. The Satcom business line saw the carryover effects of COVID-19 from the fourth quarter of 2020 on its revenue but experienced stronger order intake in the first quarter of 2021, finishing the quarter with a robust order backlog.

Asia Pacific Group

In the fourth quarter of 2020, the Asia Pacific business line was awarded a contract to produce an antenna for use in a consumer product. This award represented an opportunity to diversify its business into a new product category. Although the product satisfied the customer’s technical RF specifications, the final product was found not to be acceptable as a retail product, resulting in significant customer returns. We therefore made the difficult decision to exit this business, incurring a loss of $2.0 million in the first quarter of 2021 on this product category, with a small number of antennas remaining to be shipped in the next few months.

Credit Agreement

The Company and its lenders (Royal Bank of Canada and HSBC Bank Canada) have agreed to amend the Credit Agreement governing the Company’s credit facilities.

These amendments include an amendment to the Senior Debt to EBITDA Ratio – for fiscal quarters ending June 30 to December 31, 2021 there will not be any covenant, and for each fiscal quarter end thereafter the ratio will be 3.00:1.00.

The Company also agreed: (i) to a minimum EBITDA covenant for the trailing twelve months ending September 30 and December 31, 2021; (ii) to an increase of 0.25% in the rate of interest that would otherwise apply at any time the Senior Debt to EBITDA Ratio is equal to or more than 2.75:1.00; (iii) to an increase of 0.05% in the standby fee that would otherwise apply at any time the Senior Debt to EBITDA Ratio is equal to or more than 2.75:1.00; (iv) to a reduction of the revolving credit facility by $3 million; and, (v) to maintain minimum liquidity of at least $7 million.

There was no change to the Fixed Charge Coverage Ratio, which will remain at 1.15:1.00.

The amendments include a waiver of compliance with applicable financial covenants in respect of the fiscal quarter ended March 31, 2021.

As part of the amendments, the Company also agreed not to pay more than $100,000 in cash interest on each of the June 30 and December 31, 2021 interest payment dates on the Company’s convertible debentures without the consent of the Lenders except out of the cash proceeds from the sale of common shares or other equity interests of the Company or the payment of interest in common shares of the Company.

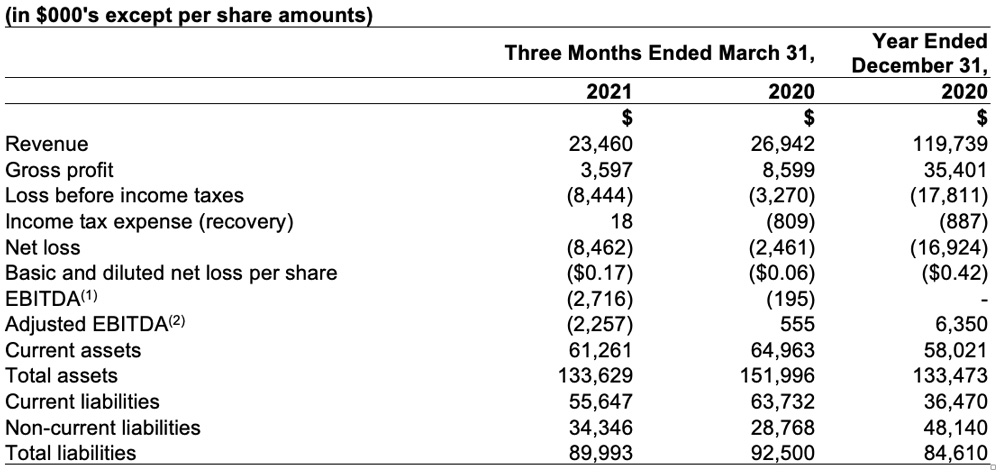

SELECTED FINANCIAL INFORMATION

The table below discloses selected financial information for the periods indicated.

(1) See “Non-GAAP Measures”. EBITDA refers to operating income (loss) plus depreciation and amortization.

(2) See “Non-GAAP Measures”. Adjusted EBITDA refers to EBITDA plus the sum of: a) acquisition expenses, fair value step up of inventory acquired as part of an acquisition, expenses for litigation relating to acquisition agreements, expenses relating to planned restructuring post an acquisition, impairment on fixed and intangible assets (including goodwill) post an acquisition; b) expenses to permanently close/relocate a facility, shut down a line of business, eliminate positions; c) corporate re-organization expenses; and, d) non-cash compensation.

(3) See “Non-GAAP Measures”. Gross margin refers to gross profit divided by revenue.

A copy of the Company’s unaudited interim condensed consolidated financial statements for the three months ended March 31, 2021 and corresponding management’s discussion and analysis (the “MD&A”) are available under the Company’s SEDAR profile on www.sedar.com.

OUTLOOK

Although COVID-19 had a negative impact on our financial results in the first quarter of 2021, we remain optimistic that financial results will improve quarter-over-quarter (subject to seasonal variations) for the remainder of 2021.

The outlook for the Wireless Infrastructure business line for 2021 has improved for several reasons:

- Completion of the 5G spectrum auction in December 2020, which will spur new investments across our carrier partners;

- Several projects delayed in 2020 are now scheduled for 2021;

- New carrier supplier status wins for small cells for which revenue commenced in the first quarter of 2021; and,

- BSA wins with a Tier 1 North American carrier.

The outlook for the Asia Pacific business line for 2021 has also improved due to pent up demand across numerous consumer segments resulting from the COVID-19 lockdowns in North America and Europe in 2020. Furthermore, Asia Pacific has secured additional key model wins with its key customers and likewise has aggressively pushed into other product segments such as tablets and laptops.

The Embedded Antenna business line is expected to continue to perform well in 2021 with gross margin(3) expected to improve throughout the balance of 2021 due to a capital investment which will automate a portion of the manufacturing process of one of its highest volume products. The increase in consumer demand for Wi-Fi 6 products, coupled with recent large platform wins in this market, have this business expecting growth for 2021.

The Satcom business line has been directly affected by the severe downturn in the airline and cruise ship industries although there are signs a recovery may occur in the second half of 2021. By contrast, we have seen a significant increase in military proposals and contract wins to new and existing customers for large opportunities that are expected to commence shipments in the first half of 2021. The launch of our new Summit Series II solid state power amplifier has achieved early success with a key customer win. This platform has been an enormous undertaking for our team, and we now expect to deliver our first system in the second quarter of 2021, with other awards expected to be delivered soon afterwards. We believe that there is no other platform in the market that can deliver the capabilities of our Summit Series II and that it will open up multi-million-dollar opportunities in both our traditional GEO domain and the rapidly emerging LEO constellations.

Completion of our new MMU facility in Vietnam remains a challenge. We continue to experience delays in final commissioning and approval of the facility, principally due to the effect of COVID-19 related travel restrictions. That, together with softer demand in the MMU sector, means the timing for volume production from the facility remains uncertain.

We caution that the degree of our operational and financial performance will depend on the duration and spread of COVID-19, the effectiveness of vaccines and the actions taken by governments and others to curtail the spread of COVID-19, all of which are uncertain and cannot be predicted.

INVESTOR CONFERENCE CALL

Baylin will hold a conference call on May 11, 2021 at 8:00 a.m. (ET) to discuss its financial results for the three months ended March 31, 2021. The call will be hosted by Randy Dewey, President and Chief Executive Officer, Cliff Gary, Vice President Finance and Daniel Kim, Executive Vice President of Corporate Development. All interested parties are invited to participate using the dial-in details provided below.

Date: May 11, 2021

Time: 8:00 a.m. (ET)

Dial-in Number: 888-231-8191 or 647-427-7450

Conference ID#: 4817719

Webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1427574&tp_key=5149e87c0f

FORWARD-LOOKING STATEMENTS

This press release includes forward-looking information and forward-looking statements (together, “forward-looking statements”) within the meaning of applicable securities laws. They are not statements of historical fact. Rather, they are disclosure regarding conditions, developments, events or financial performance that we expect or anticipate may or will occur in the future including, among other things, information or statements concerning our objectives and strategies to achieve those objectives, statements with respect to management’s beliefs, estimates, intentions and plans, and statements concerning anticipated future circumstances, events, expectations, operations, performance or results. Forward-looking statements can be identified generally by the use of forward-looking terminology, such as “anticipate”, “believe”, “could”, “should”, “would”, “estimate”, “expect”, “forecast”, “indicate”, “intend”, “likely”, “may”, “outlook”, “plan”, “potential”, “project”, “seek”, “target”, “trend” or “will” or the negative or other variations of these words or other comparable words or phrases and is intended to identify forward-looking statements, although not all forward-looking statements contain these words.

The forward-looking statements in this press release include statements concerning the continuing effect of the COVID-19 pandemic on our business, the outlook for our business lines otherwise, timing of new products and revenue, and timing of commencement of production from our new factory in Vietnam. Forward-looking information and statements are based on certain assumptions and estimates made by us in light of the experience and perception of historical trends, current conditions, expected future developments, including projected growth in sales of passive and active radio frequency and terrestrial microwave products and services, and other factors we believe are appropriate and reasonable in the circumstances, but there can be no assurance that such assumptions and estimates will prove to be correct.

Many factors could cause our actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including the risk factors discussed in the Company’s most recent Annual Information Form, which is available under the Company’s profile on SEDAR at www.sedar.com. All the forward-looking statements made in this press release are qualified by these cautionary statements and other cautionary statements or factors in this press release. There can be no assurance that the actual results or developments will be realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company. Unless required by applicable securities law, the Company does not intend and does not assume any obligation to update these forward-looking statements.

NON-GAAP MEASURES

This press release includes a number of measures that are not prescribed by Canadian generally accepted accounting principles (“GAAP”) and as such may not be comparable to similar measures presented by other companies. We believe these measures are commonly employed to measure performance in our industry and are used by analysts, investors, lenders and interested parties to evaluate financial performance and our ability to incur and service debt to support our business activities. While management of the Company believes that non-GAAP measures are helpful supplemental information, they should not be considered in isolation as an alternative to net income, cash flows generated by operating, investing or financing activities, or other financial statement data presented in accordance with GAAP. See “Non-GAAP Measures” on page 2 of the MD&A for further information.

ABOUT BAYLIN

Baylin Technologies Inc. is a leading diversified global wireless technology company. Baylin focuses on research, design, development, manufacturing and sales of passive and active radio frequency products, terrestrial microwave products, and services. Baylin aspires to meet its customers’ needs and anticipate the direction of the market. For further information, please visit www.baylintech.com.