NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

Conference Call on March 10, 2022 at 8:00 a.m. ET

TORONTO, CANADA – March 9, 2022 – Baylin Technologies Inc. (TSX: BYL) (the “Company” or “Baylin”), a diversified global wireless technology company focused on research, design, development, manufacturing and sales of passive and active radio frequency products, satellite communications products, and supporting services, today announced its financial results for the three and twelve months ended December 31, 2021. All amounts are stated in Canadian dollars unless otherwise indicated.

FOURTH QUARTER SUMMARY

- Adjusted EBITDA(2) of $0.9 million in the fourth quarter of 2021, the first quarter of positive Adjusted EBITDA since the third quarter of 2020. Adjusted EBITDA in the fourth quarter of 2021 was an increase of $1.3 million compared to the fourth quarter of 2020. The increase in Adjusted EBITDA was due primarily to an increase in revenue and gross profit discussed below partially offset by higher operating expenses compared to the prior year period.

- Historically high levels of backlog(3) of $38.3 million at February 28, 2022 and $36.4 million at December 31, 2021, led by the Satcom and Embedded Antenna business lines. Backlog at December 31, 2021 increased by $19.3 million or 112.9% from December 31, 2020.

- Revenue of $27.2 million in the fourth quarter of 2021, an increase of $1.6 million or 6.3% compared to the fourth quarter of 2020. The increase was mainly due to stronger revenue from the Embedded Antenna business line in part due to increased availability of global chipsets despite the supply chain challenges.

- Gross profit of $8.8 million in the fourth quarter of 2021, an increase of $2.1 million or 30.6% compared to the fourth quarter of 2020. Gross margin was 32.3% in the fourth quarter of 2021 compared to 26.3% in the fourth quarter of 2020. Gross margin was primarily impacted by improved product mix. The increase in gross margin was attributable to improved gross margins in the Satcom and Embedded Antenna business lines in the fourth quarter of 2021 compared to the prior year period. The improvement in gross margin in the Satcom business line included the impact of an inventory provision release of $1.6 million.

- Despite Adjusted EBITDA of $0.9 million, net loss of $20.1 million in the fourth quarter of 2021 compared to net loss of $9.4 million in the fourth quarter of 2020. The net loss in the fourth quarter of 2021 was mainly due to operating loss which included a non-current asset impairment provision of $10.1 million and income tax expense which included a $7.1 million reduction in the carrying value of deferred tax assets. On a per share basis, the fourth quarter of 2021 produced a net loss of $0.26 per share compared to a net loss of $0.23 per share in the fourth quarter of 2020.

- Completed the second tranche of a private placement of 5,883,000 common shares, raising $5 million, the net proceeds from which were used to partially repay outstanding debt and for general corporate purposes.

FISCAL YEAR SUMMARY

- Raised $15 million in a private placement of 17,648,000 common shares, the net proceeds from which were used to partially repay outstanding debt and for general corporate purposes.

- Revenue of $102.5 million in fiscal 2021, a decrease of $17.2 million or 14.4% compared to fiscal 2020. The decrease was primarily due to softer sales across all business lines in fiscal 2021 attributable to the impact of the COVID-19 pandemic, global chipset shortages and supply chain constraints.

- Gross profit of $15.1 million in fiscal 2021 compared to $35.4 million in fiscal 2020. Gross margin was 14.7% in fiscal 2021 compared to 29.6% in fiscal 2020. Gross margin was negatively impacted in fiscal 2021 by an overall decrease in sales volumes across the Company’s business lines. The decrease in gross profit was also due to a write-down of $4.0 million against inventory in the Satcom business line, an accumulated loss of $4.1 million on a consumer product in the Asia Pacific business line and lower gross margins generated by the Asia Pacific business line as a result of lower margin products making up a larger portion of the remaining gross profit.

- Net loss of $67.4 million in fiscal 2021 compared to net loss of $16.9 million in fiscal 2020. The net loss in fiscal 2021 was primarily due to operating loss which included non-current asset impairments of $26.0 million, income tax expense, which included a $7.1 million reduction in the carrying value of deferred tax assets, as well as a fair value adjustment to the Debentures. On a per share basis, fiscal 2021 generated a net loss of $1.09 per share compared to a net loss of $0.42 per share in fiscal 2020.

- Adjusted EBITDA of ($14.8) million in fiscal 2021 compared to $6.4 million in fiscal 2020. Adjusted EBITDA was negatively impacted in fiscal 2021 by an overall decrease in sales volumes across all the business lines. Additionally, the decrease in Adjusted EBITDA was due to lower gross margins generated by the Satcom business line due to the inventory write-down noted above and the Asia Pacific business line as a result of lower margin products making up a larger portion of the remaining gross profit, partially offset by lower operating expenses compared to fiscal 2020.

- Net cash as at December 31, 2021 was $8.9 million, an increase of $7.8 million from December 31, 2020, primarily due to proceeds from the private placement, proceeds from the exercise in March 2021 of common share purchase warrants issued in December 2020, drawdown of the Vietnam Loan and a decrease in non-cash working capital, offset by operating losses and principal and interest payments.

RECENT DEVELOPMENTS

Private Placement

The Company issued 17,648,000 common shares at $0.85 per share in two tranches for aggregate proceeds of $15 million. The first tranche of 11,765,000 common shares, completed on September 1, 2021, resulted in gross proceeds of $10 million, and the second tranche of 5,883,000 common shares, completed on October 21, 2021, resulted in gross proceeds of $5 million. The Company’s largest shareholder, 2385796 Ontario Inc., purchased all 11,765,000 common shares in the first tranche and 5,460,192 common shares in the second tranche, with the remaining 422,808 common shares purchased by other insiders of the Company. Mr. Jeffrey C. Royer, Chairman of the Board of Directors of the Company, exercises control and direction over investment decisions of the shareholder. The Company relied on the “financial hardship” exemption available to it under the rules of the Toronto Stock Exchange (“TSX”) and applicable securities laws to complete the private placement and to permit the insiders to purchase the shares. All the common shares are listed on the TSX.

Credit Facility

The Company and its lenders (Royal Bank of Canada and HSBC Bank Canada) have agreed to amend the Credit Agreement to extend the maturity date of the credit facilities from March 29 to September 30, 2022. This will provide the Company with additional time either to renew the existing credit facilities when they mature or to find alternative credit facilities. The Company is currently in discussions with several prospective lenders and advisors for that purpose. During the period of the extension, the Company will be required to continue to maintain a minimum Liquidity of $10 million and Fixed Charge Coverage Ratio of 1.15:1.00.

MMU Facility

Over the course of the COVID-19 pandemic, our customer’s sales of its massive multiple-input multiple-output product (“MMU”) softened considerably. This led the customer to significantly lower its sales forecast, as well as to redesign the product to reduce its complexity and cost. As a result, in November 2021 we announced that, in light of market conditions exacerbated by COVID-19 and changes to the product design, we would be assessing the long-term options for our MMU facility in Vietnam. We have now concluded that the facility will not enter production for its intended purpose and have decided to liquidate the assets of the facility and apply the sales proceeds in repayment of the Vietnam Loan. Consequently, the Company recorded an aggregate $10.0 million impairment provision consisting of a $6.8 million impairment of property, plant and equipment, $2.3 million impairment of right of use assets and $0.9 million impairment of intangibles in the fourth quarter of 2021 all related to the MMU facility.

Vietnam Loan

The MMU facility and equipment was financed in part by the Company’s Vietnamese subsidiary, Galtronics Vietnam Dai Dong Company Limited (“GTD”), with the Vietnam Loan provided by HSBC Vietnam. The Vietnam Loan required GTD and its parent, Galtronics Vietnam Company Limited (“GTV”), as guarantor of the Vietnam Loan, to meet certain financial covenants. In light of the situation with the MMU facility, if those covenants had been tested (as required) on December 31, 2021 those tests would not have been met, but HSBC Vietnam agreed, as part of ongoing discussions with the Company, to waive the financial covenant requirements. As a result of those discussions, the parties have settled a term sheet under which the Vietnam Loan will now become payable in full on August 18, 2022 and Baylin will provide an unsecured guarantee of the remaining balance of the Vietnam Loan in favour of HSBC Vietnam.

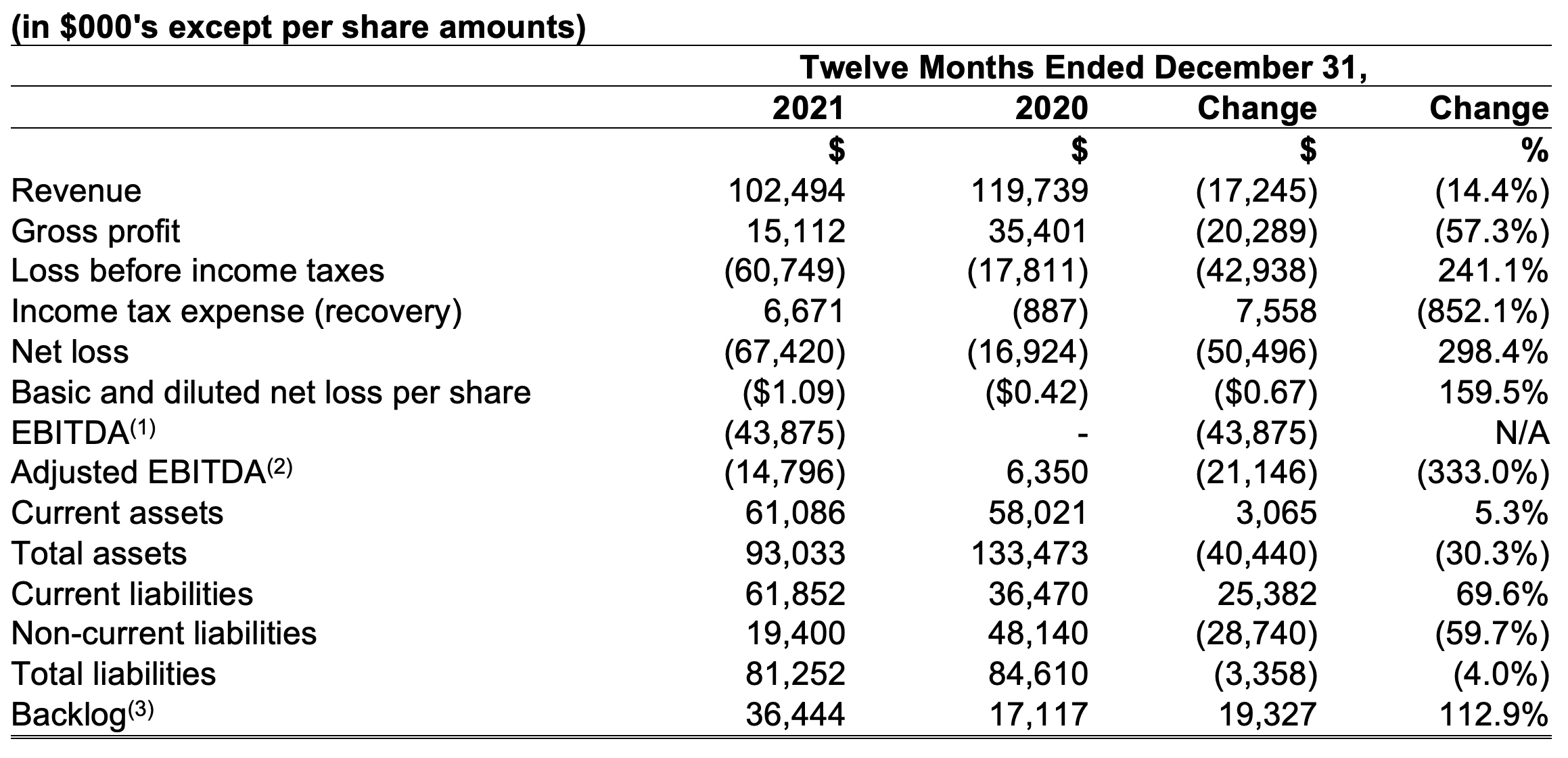

SELECTED FINANCIAL INFORMATION

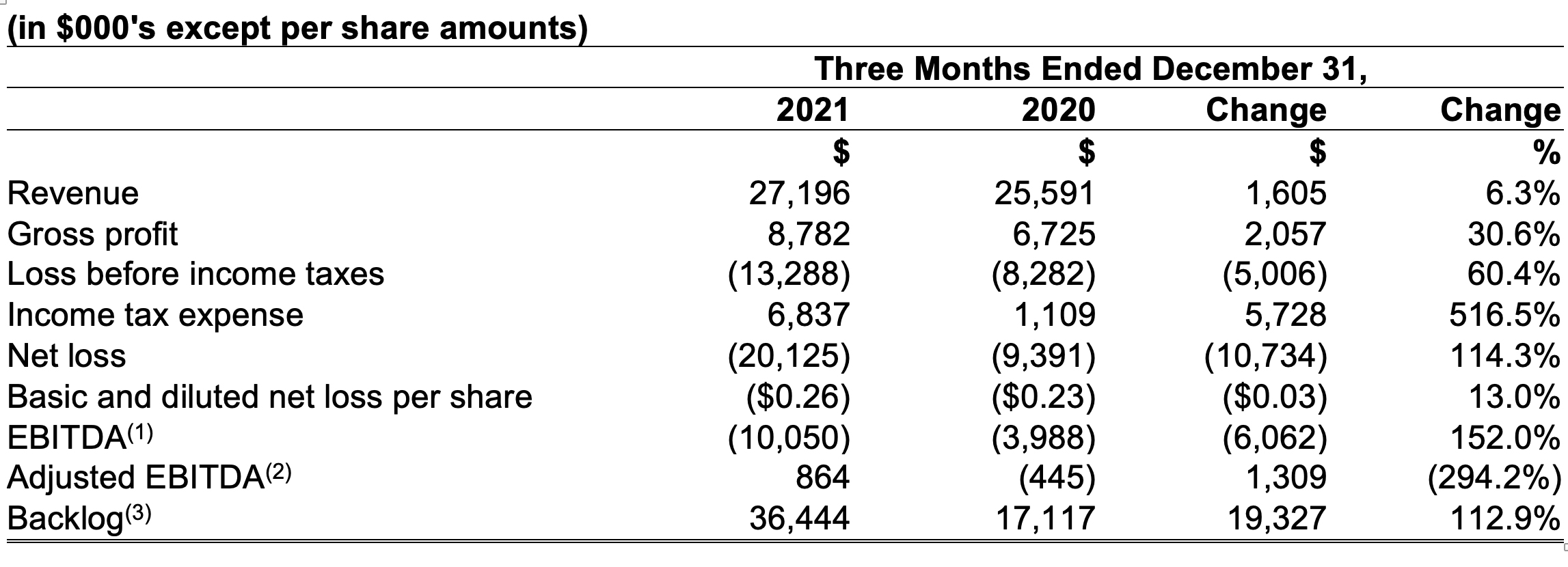

The table below discloses selected financial information for the twelve months ended December 31, 2021 compared to the prior year period.

The table below discloses selected financial information for the three months ended December 31, 2021 compared to the prior year period.

- See “Non-IFRS Measures”. EBITDA refers to operating income (loss) plus depreciation and amortization.

- See “Non-IFRS Measures”. Adjusted EBITDA refers to EBITDA plus the sum of: a) acquisition expenses; b) fair value step-up of inventory acquired as part of an acquisition; c) expenses for litigation relating to acquisition agreements; d) expenses relating to planned restructuring post an acquisition; e) impairment on fixed and intangible assets (including goodwill) post an acquisition; f) expenses to permanently close/relocate a facility, shut down a line of business, eliminate positions; g) expenses related to corporate re-organization; and, h) non-cash compensation.

- See “Non-IFRS Measures”. Backlog refers to the value of unfulfilled purchase orders placed by customers.

A copy of the Company’s consolidated financial statements for the three and twelve months ended December 31, 2021 and corresponding management’s discussion and analysis (the “MD&A”) are available under the Company’s SEDAR profile on www.sedar.com.

OUTLOOK

The Company’s business continues to face challenges brought about by the COVID-19 pandemic, in particular shortages and increased materials costs due to supply chain disruptions, although we expect these disruptions will begin to ease over the second half of 2022 as spending generally moves away from goods and back into services. Travel restrictions continue to hamper some business activities as well as international travel. Despite these continuing challenges, we are seeing improvements in all areas of our business and expect that 2022 will show improvements in both revenue and Adjusted EBITDA over 2021.

We are monitoring the current conflict in Ukraine and its effect on our business. Although our direct exposure to customers in Russia and Ukraine is minimal, the conflict there may indirectly impact our business given the sanctions imposed upon Russia, particularly in terms of supply chain and commodity prices. While it is too early to definitively quantify the impact these sanctions will have on our business, thus far the impacts have been manageable.

Asia Pacific Business Line

In 2022, we plan to conduct a review of Asia Pacific’s product portfolio with a view to right-sizing its product mix. This product rationalization is intended to improve the contribution margin of this business line, even if it is at the expense of foregoing additional revenue. Nevertheless, we do expect stronger revenue growth over 2021. The antenna we were producing for use in a consumer product for our major customer, although at declining production volumes, is expected to end in the second quarter of 2022 when the program comes to an end. Due to steps taken to improve the economics of the product, we have not incurred any further losses on this program.

Embedded Antenna Business Line

We expect the Embedded Antenna business line to show considerable strength in the first half of 2022, with growth in both revenue and volume, due in part to demand from new customers for home networking products. This continues the strong increase in revenue and volume from the second half of 2021, despite a significant global chipset shortage in 2021, which impacted customers’ build schedules and forecasts. The Embedded Antenna business line continues to demonstrate a strong order book despite supply chain challenges, though some of the strength may reflect pre-purchases by customers to build supply of stock.

Wireless Infrastructure Business Line

We expect the first half of 2022 to be challenging for the Wireless Infrastructure business line, with lower revenue than in the second half of 2021. Customer spending is focused on prioritizing deployment of integrated base station antennas for 5G networks in urban areas over small cell deployments, where the Wireless Infrastructure business line has historically been strongest. We expect distributed antenna systems (DAS) deployments will strengthen, particularly for use in stadiums and as people return to the office, later in 2022. New Multibeam BSA antennas from Galtronics will come to market in the second half of the year, opening new opportunities to drive sales with wireless carriers.

Satcom Business Line

The commercial side of the Satcom business line continues somewhat to feel the effects of the downturn due to the impact of COVID-19. Although there are clear signs of recovery, we expect capital spending by our commercial customers to remain somewhat constrained in the first half of 2022 with a more sustained recovery becoming evident in the second half of the year. The C-band spectrum auction in the United States is beginning to open up opportunities with satellite operators as they have received the first round of incentive payments based on clearing their C-band spectrum. Given the capital build cycles of these operators and others in the Satcom ecosystem, we expect the benefit to the Satcom business line from the build-out of the related C-band infrastructure to begin in the second half of 2022.

We expect sales for military and other government-related uses, which represents the balance of Satcom’s business, to improve in 2022. We expect to make additional deliveries of our Ultra High-Power Summit II solid state power amplifiers over the course of the year. We believe that there is no other platform in the market that can deliver the capabilities of our Summit II. Moreover, we expect to launch multiple technology upgrades within our product portfolio over the course of the calendar year.

Overall, we expect revenue of the Satcom business line to be stronger in 2022 as certain industries start to invest as the world comes out of the COVID-19 pandemic. The Satcom business line continues to show a strong and growing order book but is facing supply chain constraints and a push-out of customer orders.

INVESTOR CONFERENCE CALL

Baylin will hold a conference call on March 10, 2022 at 8:00 a.m. (ET) to discuss its financial results for the three and twelve months ended December 31, 2021. The call will be hosted by Leighton Carroll, Chief Executive Officer, Dan Nohdomi, Chief Financial Officer, and Daniel Kim, Executive Vice President of Corporate Development. All interested parties are invited to participate using the dial-in details provided below.

Time: 8:00 a.m. (ET)

Dial-in Number: 888-664-6392 or 416-764-8659

Conference ID#: 61217897

Webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1527770&tp_key=3a543f9baf

FORWARD-LOOKING INFORMATION AND STATEMENTS

This press release includes forward-looking information and forward-looking statements (together, “forward-looking statements”) within the meaning of applicable securities laws. Forward-looking statements are not statements of historical fact. Rather, forward-looking statements are disclosure regarding conditions, developments, events or financial performance that we expect or anticipate may or will occur in the future including, among other things, information or statements concerning our objectives and strategies to achieve those objectives, statements with respect to management’s beliefs, estimates, intentions and plans, and statements concerning anticipated future circumstances, events, expectations, operations, performance or results. Forward-looking statements can be identified generally by the use of forward-looking terminology, such as “anticipate”, “believe”, “could”, “should”, “would”, “estimate”, “expect”, “forecast”, “indicate”, “intend”, “likely”, “may”, “outlook”, “plan”, “potential”, “project”, “seek”, “target”, “trend” or “will” or the negative or other variations of these words or other comparable words or phrases and is intended to identify forward-looking statements, although not all forward-looking statements contain these words.

The forward-looking statements in this press release include statements concerning the continuing effect of the COVID-19 pandemic on our business, the outlook for our business lines, including backlog, and settling final documentation amending the Vietnam Loan. Forward-looking information and statements are based on certain assumptions and estimates made by us in light of the experience and perception of historical trends, current conditions, expected future developments, including projected growth in sales of passive and active radio frequency and satellite communications products, and supporting services, and other factors we believe are appropriate and reasonable in the circumstances, but there can be no assurance that such assumptions and estimates will prove to be correct.

Many factors could cause our actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including the risk factors discussed in the Company’s most recent Annual Information Form, which is available under the Company’s profile on SEDAR at www.sedar.com. All the forward-looking statements made in this press release are qualified by these cautionary statements and other cautionary statements or factors in this press release. There can be no assurance that the actual results or developments will be realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company. Unless required by applicable securities law, the Company does not intend and does not assume any obligation to update any forward-looking statements.

NON-IFRS MEASURES

This press release includes a number of measures that are not prescribed by International Financial Reporting Standards (“IFRS”) and as such may not be comparable to similar measures presented by other companies. We believe these measures are commonly employed to measure performance in our industry and are used by analysts, investors, lenders and interested parties to evaluate financial performance and our ability to incur and service debt to support business activities. While management of the Company believes that non-IFRS measures provide helpful supplemental information, they should not be considered in isolation as an alternative to net income, cash flows generated by operating, investing or financing activities, or other financial statement data presented in accordance with IFRS. See “Non-IFRS Measures” on page 2 of the MD&A for further information.

ABOUT BAYLIN

Baylin Technologies Inc. is a diversified global wireless technology company. Baylin focuses on research, design, development, manufacturing and sales of passive and active radio frequency products, satellite communications products, and supporting services.

For further information, please visit www.baylintech.com.